Purchasing a used two-wheeler from an online auction can be a great way to get a good deal. However, it's important to take some precautions before making the purchase. One of the most important steps you can take is to insure your vehicle.

In India, two-wheeler insurance is mandatory under the Motor Vehicles Act, 1988. It not only provides financial protection against accidents, theft or natural calamities but also covers third-party liabilities. In this guide, we'll take you through the process of insuring your used two-wheeler from an online auction.

1. Choose the Right Type of Insurance

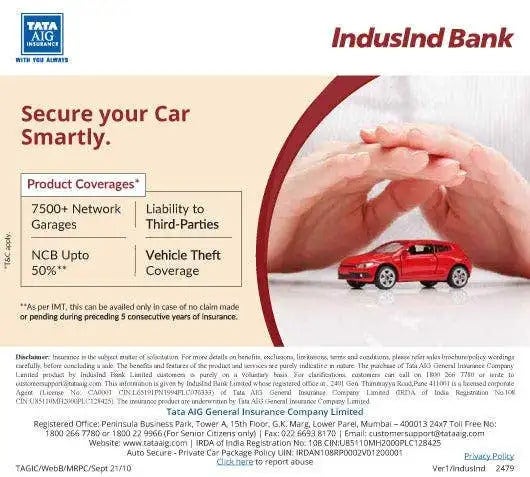

Before you purchase insurance for your used two-wheeler, you need to choose the right type of policy. There are two types of policies available – third-party liability insurance and comprehensive insurance.

Third-party liability insurance covers only the damages caused to a third party in case of an accident. On the other hand, comprehensive insurance covers damages to your vehicle, third-party liability, and theft.

While third-party insurance is mandatory, it's advisable to opt for comprehensive insurance to protect your investment. It's worth noting that the premium for comprehensive insurance is higher than that for third-party liability insurance

2. Check the Insurance History of the Two-Wheeler

Before purchasing a used two-wheeler from an online auction, it's essential to check the insurance history of the vehicle. You can do this by asking the seller to provide the policy details or the policy number. If the seller fails to provide this information, it's best to walk away from the deal.

Checking the insurance history of the two-wheeler will give you an idea about the claims made, any past accidents, or any damages incurred. It will help you in making an informed decision about the purchase.

3. Transfer the Insurance Policy in Your Name

Once you have purchased the used two-wheeler, you need to transfer the insurance policy in your name. This process is known as insurance transfer, and it's a legal requirement.

To transfer the policy, you need to submit a few documents such as the original policy document, the registration certificate of the vehicle, and your identity proof. You may also need to pay a nominal fee for the transfer.

4. Renew the Insurance Policy Regularly

After purchasing insurance for your used two-wheeler, it's essential to renew the policy regularly. In India, two-wheeler insurance policies are valid for one year, and you need to renew the policy before it expires.

Failing to renew the policy on time can lead to a lapse in coverage. If an accident or theft occurs during the lapse period, you'll have to bear the financial burden. It's advisable to set a reminder for the renewal date or opt for an auto-renewal facility.

5. Compare Insurance Policies Before Purchasing

Before purchasing insurance for your used two-wheeler, it's advisable to compare policies from different insurance providers. You can use online insurance aggregators to compare policies, premium rates, and benefits.

Comparing policies will help you in getting the best deal for your money. You can also consider add-ons such as zero depreciation, personal accident cover, and engine protection cover to enhance the coverage.

Insuring your used two-wheeler is an important step in protecting your investment. By following the above steps, you can insure your vehicle from an online auction and enjoy peace of mind while riding. Remember to choose the right type of insurance, check the insurance history of the vehicle, transfer the policy in your name, renew the policy regularly, and compare policies before purchasing.